All Recurring Payment Methods In One Platform

Looking for a comprehensive solution that offers all recurring payment methods you need? We're here to revolutionise the way you handle payments by providing you with a flexible and customisable platform that combines all recurring payment options in one place.

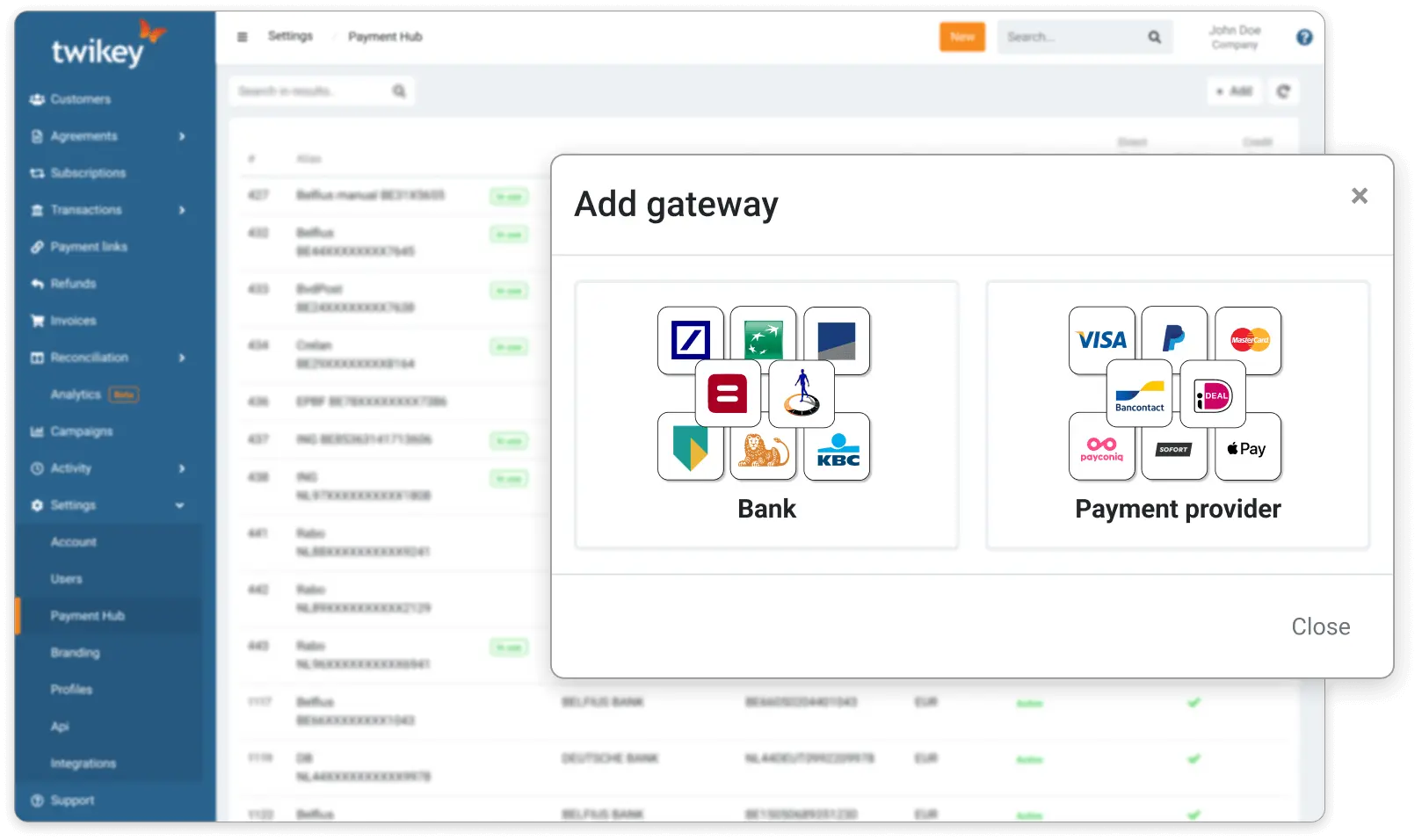

Link with the Bank or Payment Service Provider of your choice

The Power of Combined Recurring Payment Methods

We understand that every business has unique requirements when it comes to collecting recurring payments. That's why we offer the ability to combine multiple payment methods, tailored to your specific needs. By leveraging our platform, you can customise the payment flow and offer your customers a seamless and personalised payment experience.

Payment OrchestrationSEPA Direct Debit

SEPA Direct Debit allows you to collect payments from 400 million bank accounts across 36 countries in Europe. This provides access to a larger customer base and enables you to expand your market reach beyond domestic boundaries.

Twikey stands out due to its direct integration of the direct debit payment process with your personal bank account. This ensures that all fund collections are deposited directly into your designated bank account.

SEPA Direct Debit

Recurring Credit Card

Recurring credit card payments offer global accessibility and flexible billing cycles, using established credit card networks for secure processing. Customers grant explicit authorisation for ongoing charges, and the ease of modification or cancellation provides control over financial commitments.

These payments require only a valid credit card, simplifying setup without necessitating specific accounts. Overall, recurring credit card payments provide a convenient and versatile method for managing ongoing financial obligations.

Recurring PayPal

Recurring PayPal payments offer advantages like global accessibility and buyer protection, fostering customer confidence and potentially increasing conversions. Its payment source flexibility allows customers to link various funding methods, and its integration options simplify setup on websites and apps.

Why Recurring Payments?

Convenience for Customers: Recurring payments across these payment methods offer convenience to customers by automating the payment process. Customers can set up automatic payments, eliminating the need for manual intervention each time a payment is due. This convenience enhances the customer experience and encourages long-term business relationships.

Improved Cash Flow Management: Recurring payments provide your company with predictable cash flow as payments are automatically collected at regular intervals. This helps you to better plan your finances and reduces the risk of late or missed payments. By ensuring a steady revenue stream, companies can focus on growth and operational efficiency.

Cost Savings: Manual invoicing, tracking payments, and sending reminders can be time-consuming and resource-intensive. Automating these processes through recurring payments reduces administrative tasks, freeing up valuable time and resources

Increased Customer Retention: When customers can easily manage their subscriptions or ongoing services with automatic payments, they are more likely to continue using your products or services. This improves customer loyalty and reduces churn rates.

Interesting for every Industry

Discover the sectors in which we are already active

Wholesale

Energy suppliers

E-commerce companies

Telecom providers

IT and software

Accountants

Employment agencies

(Sports) associations

Care sector and hospitals

B2B suppliers

Want to know more?

We're here to help you.

*Mandatory

Contact our team

Leave your details and we will contact you as soon as possible.

Do you represent a company?*