SEPA Direct Debit B2B

(SDD B2B)

Online signing, processing, and follow-up of SEPA Direct Debit (SDD) B2B mandates and B2B direct debits!

- Cost efficiency

- Automation

- Reduced manual processing

Unique link to banks

Online registration for SDD B2B Mandates

As the leading European provider of online recurring payment solutions, we're the only service in Belgium that enables users to sign and register SDD B2B mandates online. In the Netherlands, we execute 80% of all B2B direct debit transactions. And there's more :

- Processing within 24 hours

- Reduced error rate when registering mandate references

- Get rid of fraud!

- Debtor signs mandate using trusted signing mechanisms

- Creditor obtains legal mandate and is informed about registration

- Connected to all major banks

Sepa Direct Debit B2B

SEPA Direct Debit B2B (Single Euro Payments Area Direct Debit Business-to-Business) is a payment scheme and method designed for businesses within the European Union (EU) and European Economic Area (EEA) to facilitate electronic direct debit transactions between businesses. It is a part of the broader SEPA framework, which aims to create a unified and standardized payment system for euro-denominated transactions across the participating countries.

SEPA Direct Debit B2B allows one business to collect payments directly from another business's bank account. This payment method is typically used for recurring payments, such as subscriptions, utility bills, or supplier payments. It provides advantages such as cost efficiency, automation, and reduced manual processing, making it a preferred choice for businesses engaged in frequent and repetitive transactions.

eMandates

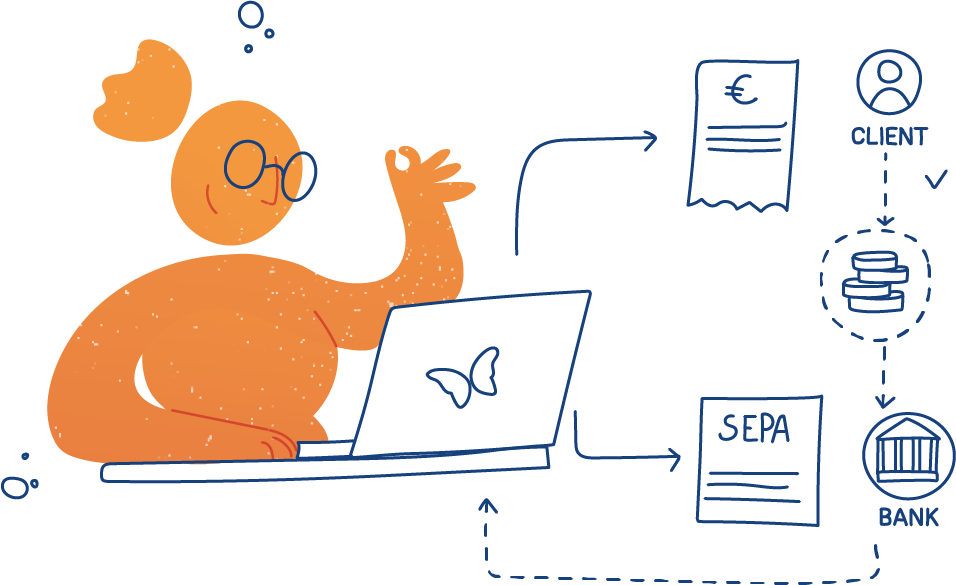

Signing SDD B2B mandates online - The process

Configure

Configure all screens in Twikey according to your corporate identity.

Invite

Invite your customer to sign a B2B mandate online via an email link, your app or website.

Sign

Your customer gives his consent by signing the mandate online via Itsme, bank card, eID, e-Machtiging,...

Feedback

Thanks to its unique link with multiple banks, Twikey immediately sends the B2B mandate online. The bank registers the B2B mandate and keeps you informed. If the mandate is refused, you immediately receive appropriate feedback and instructions.

Personalised communication with your customers

Collect through your own bank

Use your own creditor number, account and bank.

Means of communication as desired

Tailor all communications by mail, letter or SMS to your exact requirements.

Different approaches

Easily customise your approach per customer segment. Customers without a known e-mail address can, for example, be reached by letter.

Want to know more?

We're here to help you.

*Mandatory

Contact our team

Leave your details and we will contact you as soon as possible.

Do you represent a company?*